Q1 2025 Update

The transportation and logistics sector continues to experience significant shifts as macroeconomic forces influence demand, capacity, and pricing. The prolonged downturn in the freight market has forced companies to adapt to economic pressures and shifting market conditions.

Inside the Q1 2025 Transportation Outlook:

- Regulatory and Trade Impacts: Key developments in tariffs and trade policies affecting freight markets.

- Freight Capacity Trends: Analysis of supply constraints and their effect on rates and operations.

- Truckload Spot and Contract Rate Projections: Market forecasts for pricing trends in 2025.

- Modal Insights: Key developments in Drayage, Less-Than-Truckload (LTL), and Parcel sectors.

- Macroeconomic Drivers: How GDP, consumer spending, industrial output, and imports are shaping freight demand.

- Strategic Planning: Actionable insights to navigate peak season and beyond.

For a quick dive into specific topics, explore our focused sections:

- Market Trends: Tariffs, trade policies, and inflationary freight rates.

- Freight Demand and Supply Metrics: Key indicators including the Cass Freight Index and FMCSA operating authority data.

- Truckload Pricing Outlook: Contract and spot rate expectations for the coming quarters.

- Multi-Modal Forecasts: Analysis of Drayage, LTL, and Parcel market conditions.

- Economic Indicators: Trends in GDP, consumer spending, diesel fuel prices, and industrial production.

Trade, Tariffs, and Policy Changes Under the Trump Administration

The 2025 regulatory environment is reshaping global trade with significant tariff implementations:

- China: A 10% tariff on a broad range of goods to push for trade renegotiations.

- Mexico: A 25% tariff effective March 4, 2025.

- BRICS Nations (Excluding China): Potential extreme tariffs targeting select industries.

- European Union: Proposed measures to address trade imbalances.

Additionally, a 25% steel and aluminum tariff is set for implementation on March 12, 2025, impacting industries reliant on these materials, including automotive, construction, and electronics manufacturing.

De Minimis Exemption in Trade

The De Minimis exemption, allowing duty-free entry for shipments valued under $800, remains a focal point. Delays in policy changes have stalled potential modifications, but large e-commerce players like Shein and Temu remain vulnerable to regulatory shifts, which could lead to increased customs costs and higher consumer prices.

Freight Market Analysis: Supply, Demand & Pricing

Spot Freight Rate Trends

Spot rates have been inflationary, rising 7.5% YoY in Q4 2024 but saw a dip at the start of 2025. Key influencing factors include:

- Tender rejections stabilizing around 10% but expected to rise.

- Capacity exiting the market as carrier revocations surpass new authority grants.

- Consumer demand growth remains slow but positive.

Freight Supply & Demand Metrics

- Truckload Tonnage: The ATA For-Hire Truck Tonnage Index fell 3.5% in January 2025, marking the 11th consecutive YoY decline.

- Cass Truckload Linehaul Index: Increased 0.6% MoM in January 2025, the first YoY increase since December 2022.

- Carrier Operating Authority Revocations: Declined 22% YoY in 2024, but remain 64% above pre-pandemic levels.

Truckload Pricing Forecast: Spot & Contract Market

The Beon™ Band, a predictive freight pricing model, suggests continued price inflation:

- Spot Market: Inflationary trends of +17.5% YoY expected by Q4 2025.

- Contract Rates: Cass Truckload Linehaul Index projects +4.0% YoY growth by the end of 2025.

Despite capacity exiting the market, gradual demand increases suggest moderate pricing shifts rather than drastic spikes unless tender rejection rates reach double digits.

Port to Porch Forecast: Drayage, LTL, and Parcel Shipping

Drayage & Imports

- Retailers frontloading imports to avoid tariff impacts.

- Major US ports maintaining high import levels, with January 2025 projections at 2.11 million TEUs (+7.8% YoY).

- March 4, 2025: Implementation of a 25% tariff on steel and aluminum, impacting multiple industries.

LTL Shipping Trends

- Contract and spot rates projected to remain stable with minor increases.

- NMFTA freight classification changes could shift pricing structures; key decisions expected by March 3, 2025.

Parcel Market Shifts

- FedEx, UPS, and DHL implemented a 5.9% base rate increase.

- Fuel surcharges rising: FedEx Air +1.0%, Ground +1.75% (as of February 2025).

- USPS rate increases and regulatory shifts impacting e-commerce parcel shipments.

Major Carrier Strategies:

- UPS reduces reliance on Amazon, shifting toward higher-margin customers, leading to a 14.1% drop in stock price.

- Regional carriers gaining ground on FedEx and UPS through competitive pricing and service offerings.

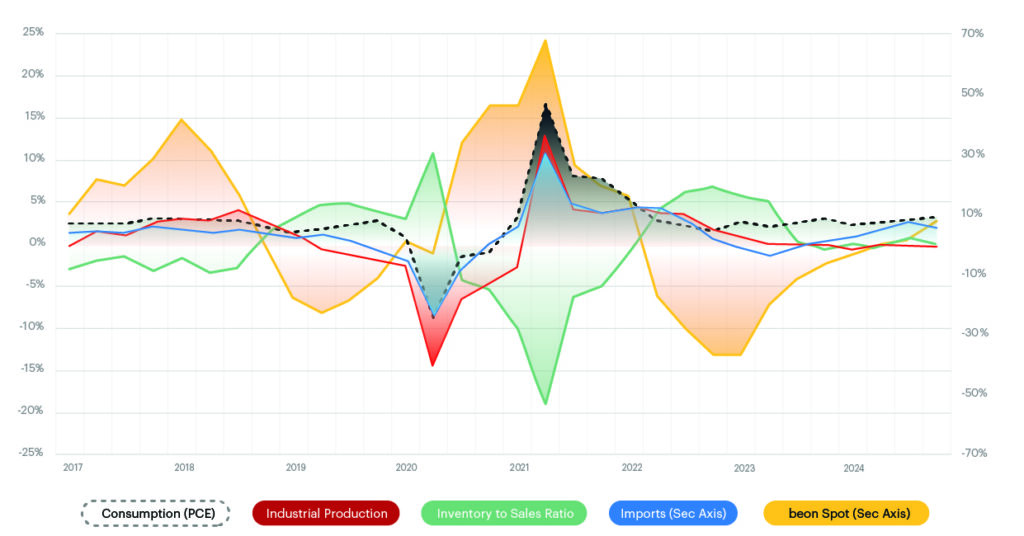

Macroeconomic Forces Shaping Freight Demand

- GDP Growth: Slowed to 2.3% in Q4 2024, with 2025 expansion forecasted at 2.8%.

- Inflation Pressures: Core PCE inflation at 2.8% YoY, with housing and labor costs driving price stickiness.

- Consumer Confidence: January 2025 CPI rose 3.0% YoY, impacting purchasing power.

- Diesel Prices: $3.665 per gallon (February 2025), down $0.444 YoY.

- Industrial Production: Grew 2.0% YoY in January 2025, with aerospace leading gains but auto manufacturing lagging.

Preparing for 2025: What to Watch

- Trade Policy Uncertainty: Further tariff discussions could create volatility.

- LTL & Parcel Pricing Adjustments: Expect continued small rate increases and potential regulatory shifts.

- Freight Cycle Evolution: As supply exits and demand stabilizes, rate inflation may accelerate.

- Macroeconomic Stability: Interest rates and inflation trends will be key indicators for freight market shifts.

The 2025 transportation landscape remains dynamic, requiring businesses to stay informed and adaptable. If you have questions or need insights tailored to your supply chain strategy, contact our team today for expert guidance.